Updated EWS1 guidance is welcome, but it doesn’t solve the problem

Mike Fox, Managing Director of MAF Associates, offers his perspective on the recently updated guidance on EWS1 forms in residential buildings below 18m. More defined guidance led by long-term strategies and clear parameters is required for it to really affect change in the industry, he argues.

The UK Government recently issued clarificatory guidance on the need for EWS1 forms in residential buildings below 18 metres, stating that they are only required if the building contains identified risk factors, such as defective cladding. While the move is to be welcomed, it is not the magical elixir that some may have hoped and many leaseholders are still going to find themselves in uncertain situations when it comes to insuring, remortgaging or selling their properties.

The current government clearly feels that leadership in the fire sector is best achieved by setting basic parameters and letting the industry drum out the finer details. This is an approach we have seen tried consistently since the Grenfell fire, and time after time it has been proven not to work. This is because the multitude of competing interests, including fire risk assessors, developers, surveyors, construction companies, management companies and responsible persons, require clear direction and guidance, which ultimately only the Government can deliver.

I am not going to blame them completely, as the situation since Grenfell has been fluid and rapidly evolving, which has justified regular updates to legislation, guidance and best practice, but with the Fire Safety Act 2021 now being law, and supplementary legislation on the drawing board, we should be moving into a period of certainty, based on a clear roadmap out of the post-Grenfell crisis. As of now, I’m not seeing this.

“The Government’s intervention is welcome as the issues with EWS1 forms are well documented. However, the latest clarification statement is only part of the process, and it’s possible that it may have caused more issues than it was intended to solve.”

The EWS conundrum – the story so far

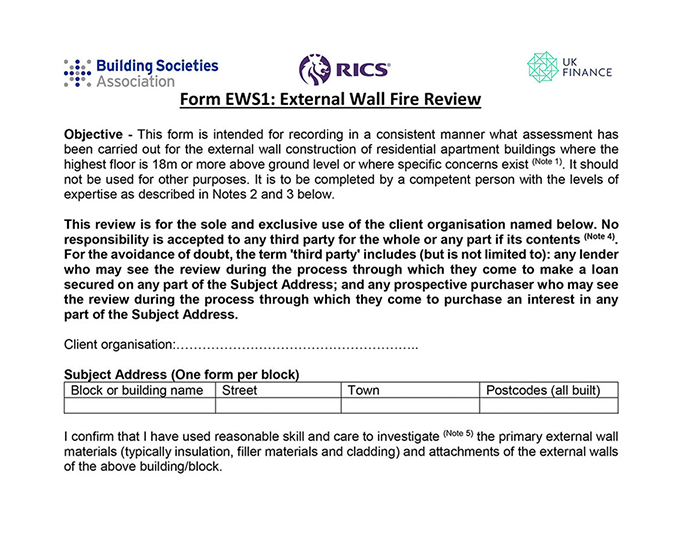

The EWS1 form was a well-intentioned plan to get long leaseholders out of the property trap created by post-Grenfell legislation and defective materials. Initial guidance from the RICS stated that it applied to all residential buildings above 18 metres “with some form of combustible cladding or combustible material on balconies.” The RICS also advised that some lower buildings might be in scope if combustible materials/balconies represented “a clear and obvious danger to life safety”. So far, so good.

Problems began to arise when insurers and mortgage lenders chose to create their own interpretations of the new rules, with many assuming that the lack of an EWS form meant that the property could not be sold and was essentially worthless, regardless of whether it was within a high-rise building or not. This created a wider issue within the industry, as we barely have capacity in the UK to inspect all of the identified ‘at risk’ buildings, never mind every single medium- and high-rise residential building, which would number somewhere close to 15,000.

The Government then exacerbated this issue in January 2020, with a consolidated Advice Note stating: “The need to assess and manage the risk of external fire spread applies to buildings of any height.” Following this announcement, owners and leaseholders in blocks lower than 18m reported lenders requesting EWS1 forms, regardless of whether the building had been classified as ‘at risk’.

On 21 November 2020, an agreement between the RICS, UK Finance, the Building Societies Association and HM Government was announced, which meant that an EWS1 form is no longer needed for sales or remortgages on flats in blocks with no cladding. The Government said this would clear the way “for up to nearly 450,000 flat owners to sell, move or re-mortgage their homes.” Supplementary guidance on fire risk assessments was issued on 21st November 2020 to reflect this new policy.

The RICS issued a new guidance note on 8th March 2021 which took effect from 5 April 2021. The guidance lists circumstances where an EWS1 form should be required and says: “…where a valuer or lender can establish that the building owner has met the advice in the consolidated advice note, an EWS1 form should not be required, nor would an EWS1 form be required for a building that is over 18 metres that has a valid building control certificate in place.”

The guidance does say some lower level blocks will still need an EWS1: “…in the light of the evidence received during the consultation, buildings of any height that have high pressure laminate (HPL) cladding and those of five stories or higher with combustible cladding linking balconies, will still need an EWS1 form.”

Despite these efforts, which in fairness seem clear enough in context, there was still widespread concern that multiple lenders were requesting EWS1 forms for buildings where they were clearly not required. You can blame confusion at the mixed messages outlined above, a determination not to get lumbered with worthless properties in the future or simply over-cautious underwriters anxious not to get their hand slapped further down the line. Either way, it was clear that further clarification was required.

Finally, on 21st July 2021, the Government issued new guidance, based on ‘expert advice’, stating that there was “no systemic risk of fire in blocks of flats under 18 metres.” It went on to state that: “EWS1 forms should not be requested for buildings below 18 metres” and said some major high street lenders had agreed to review their practices on blocks under 18 metres, based on the new expert advice. The Government is also “calling on others to demonstrate leadership by working rapidly to update guidance and policies in line with the expert advice.” Alongside this, new guidance for external wall risk assessments will be published and the January 2020 consolidated Advice Note will be withdrawn.

Remaining uncertainty

The Government’s intervention is welcome as the issues with EWS1 forms are well documented. However, the latest clarification statement is only part of the process, and it’s possible that it may have caused more issues than it was intended to solve.

The EWS1 form is a property risk form designed for a mortgage lender to make a risk-based lending decision; it is not a people-focused fire safety process. Of course, when assessing the risk of fire spread over the external walls and whether there is building risk, you are drawn into the risk to people. In fact, the MHCLG Consolidated Advice, which does form part of the EWS1 process, states that buildings of any height should be assessed. It should also be noted that the MHCLG advice is focused on people fire safety, not property safety.

What must also not be forgotten is that to understand the building risk, you must assess Building Regulation compliance, which is not property risk, but people risk. As such, the EWS1 process is very much about the people and not the building.

The Government is calling for EWS1 forms for buildings under 18 metres not to be a requirement for lending, but this is subjective and very much in the hands of the lenders. As stated in the Government’s own statement, buildings below 18 metres with HPL cladding will still require assessment. If HPL is a requirement for assessment, there are similar “risk” products such as ACM and timber that will also fall into scope. So, although there may not be a requirement due to the building height, there is still a requirement based upon product risk.

Insurance concerns

What has not been discussed is the building insurers’ view. Insurers have taken a risk-based approach to buildings with ‘cladding’ and we have seen premium increases of up to 500% on certain buildings. So, although the Government has stated its view with regard to EWS1 forms, this has not addressed the building insurers’ viewpoint, which is to offset risk with higher premiums. We could end up in a situation where a lender will lend without an EWS1 form, but a building insurer could massively increase the premium due to their risk-based approach.

Contradictory guidance

MAF Associates and other fire safety consultants and assessors are under pressure to navigate building managers and leaseholders through this process, but there are still questions we cannot answer. We are now in a position where HM Government has said there should be no requirement for lenders to request an EWS1 form for a building below 18 metres, but a lender or insurer could still require a risk-based report for the external walls.

What is also not mentioned is that the Fire Safety Act 2021 also requires the external walls of any relevant building with more than two dwellings to have the external wall assessed as part of the building fire risk assessment. To ensure that the external walls of the building are compliant, both Sections 3 and 4 of the Approved Document for Fire Safety need to be assessed. Section 3 of ADB refers to “unseen cavities”, which could exist where the external wall has a ventilated façade. Without specialist knowledge and equipment that cannot be assessed by a typical fire risk assessor, it is unlikely that the assessor would have the necessary professional indemnity to undertake this type of inspection.

Therefore, although the Government has said there should be no requirement for EWS1 forms below 18 metres, there is still a requirement to undertake the inspection and provide the risk assessment report.

Summary

While I have some sympathy with HM Government over the rapid pace of events in the post-Grenfell era, they are the only people who can hope to fill the vacuum of legislation, regulation, guidelines and best practice that has ensued. Continuous changes to the regulatory environment may be well-intentioned, but they do little to help us navigate the minefield of residential property fire inspection, safety and prevention.

As an industry, we will continue to interpret this confused guidance as best we can in the short-term, but ultimately we are crying out for clarification and definitive guidance, led by detailed legislation, clear building standards and an attainable long-term strategy. Whereas HM Government’s first instinct may be to set general parameters and then let the industry flesh out the details, we are now in a situation where definitive guidance needs to come from the top, based on valid research and consultation, of course. Until this happens, companies like MAF Associates will continue to do all that we can to help clients and partners traverse the rapidly evolving legal and regulatory environment, but uncertainty will remain for building managers and homeowners.